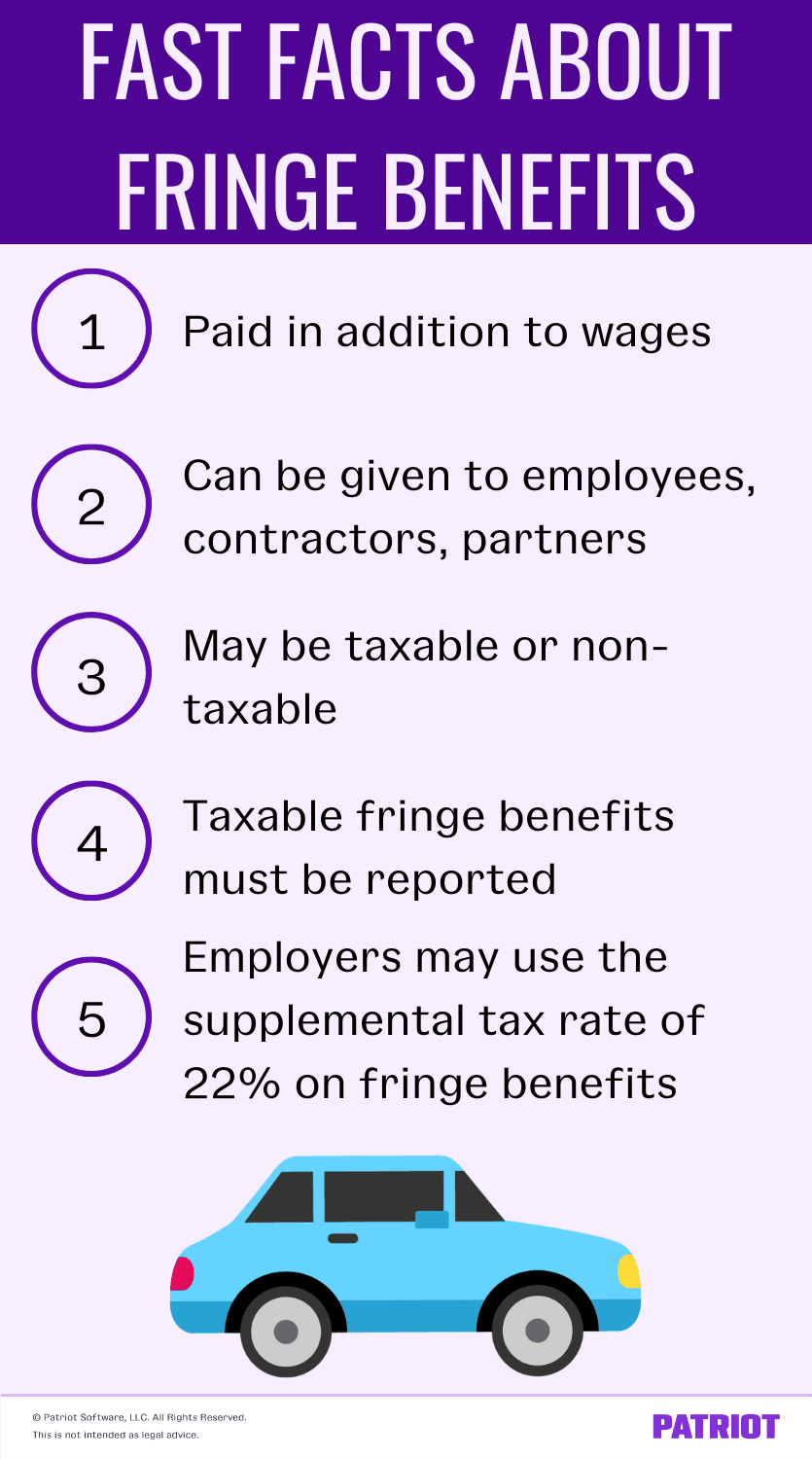

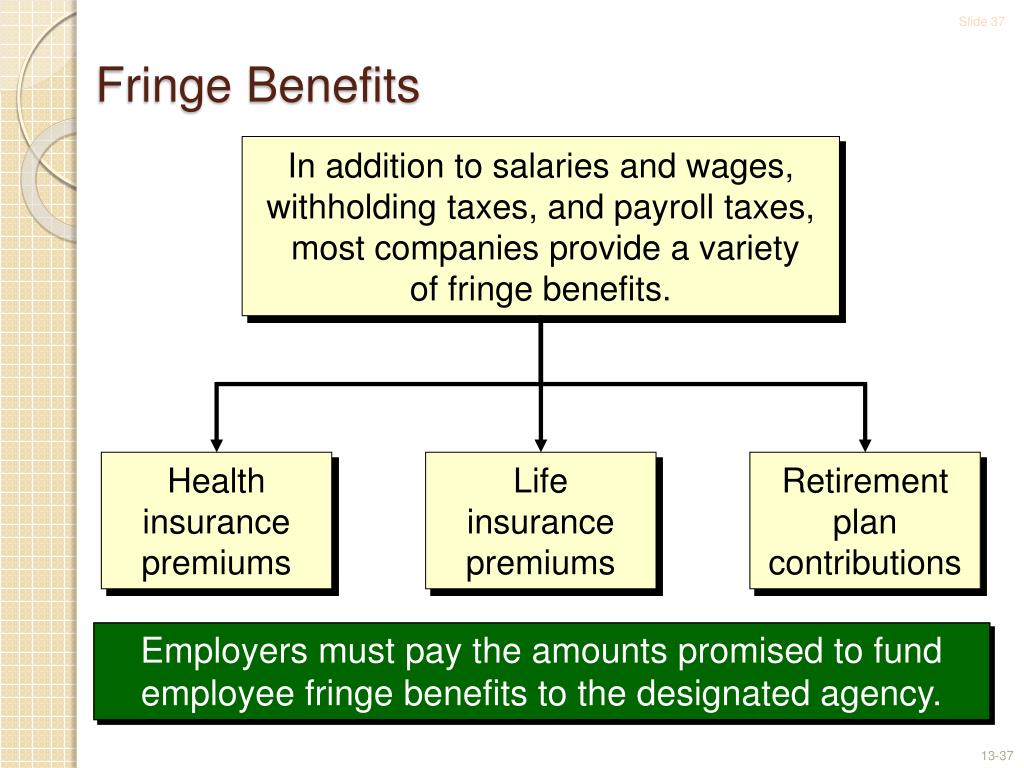

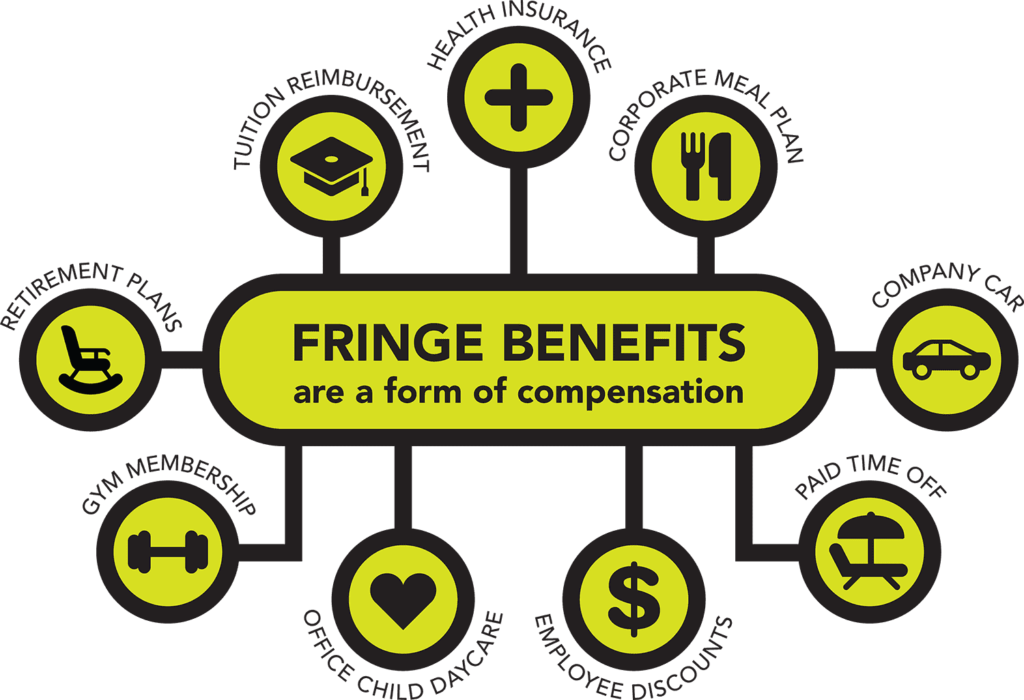

Reg. §1.61-21(b) The taxable amount of a benefit is reduced by any amount paid by or for the employee. For example, an employee has a taxable fringe benefit with a fair market value of $3.00 per day. If the employee pays $1.00 per day for the benefit, the taxable fringe benefit is $2.00 per day.. Key takeaways: Fringe benefits are a form of compensation that employers give to team members in addition to their regular salary. There are many different types of fringe benefits, including retirement plans and health club memberships. Most fringe benefits are taxable but some, such as discounts and free memberships, are free.

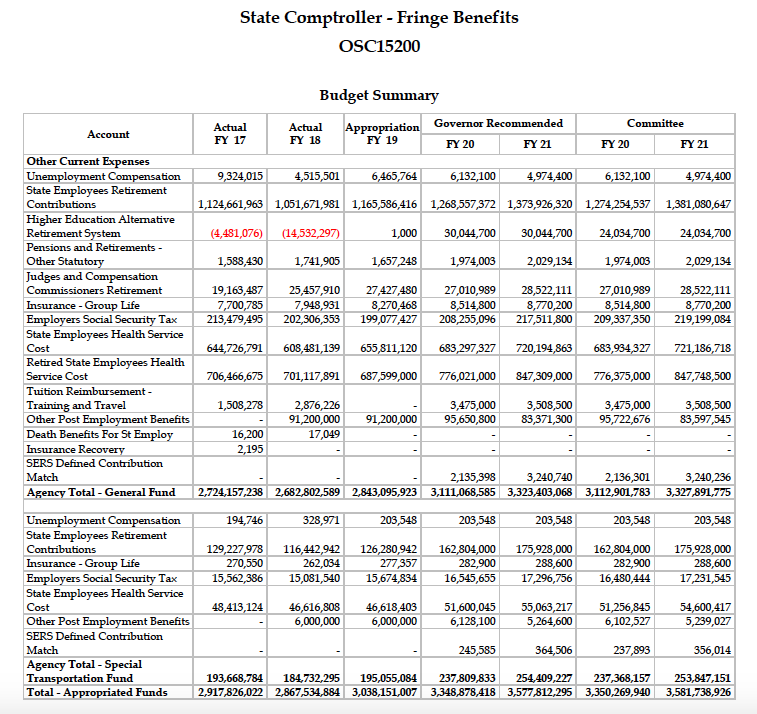

State Employee Fringe Benefit Costs to grow 544 Million over Two Years Yankee Institute

What is Fringe benefits? Job satisfaction, Budgeting tools, Personal financial advisor

Fringe Benefits Welfare Employee Benefits

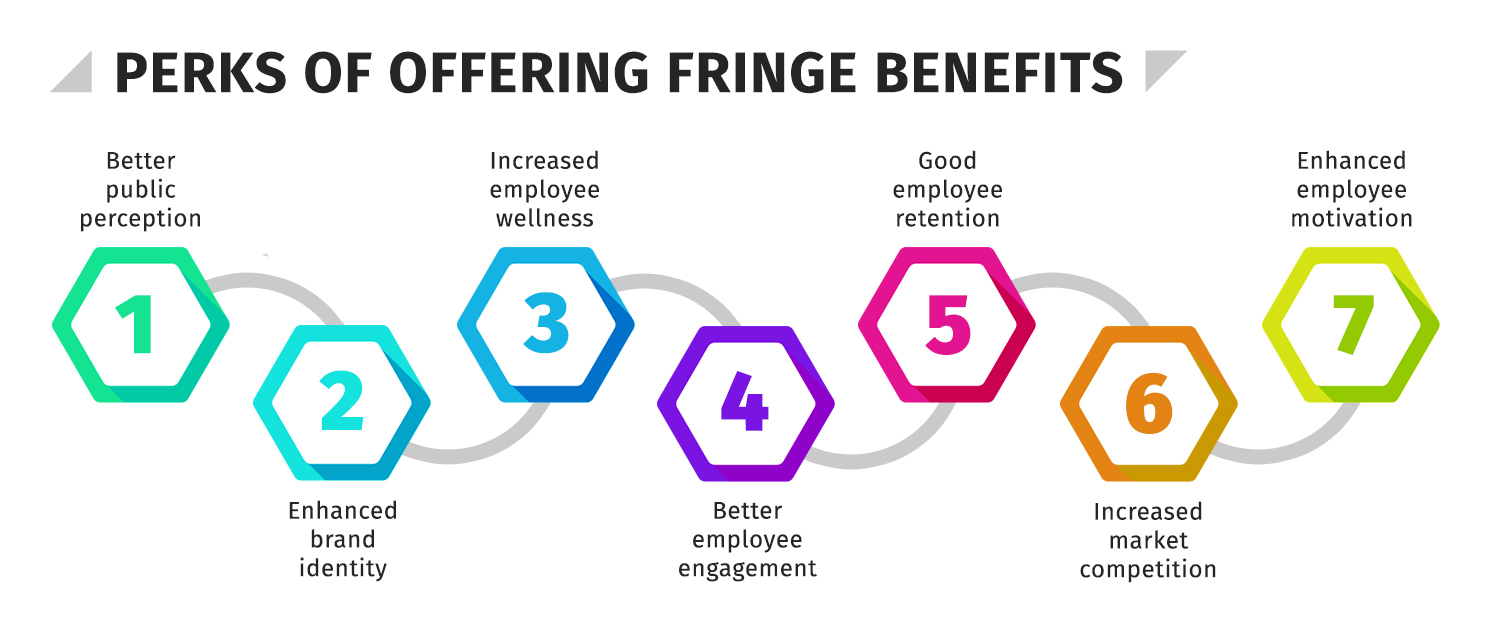

What are fringe employee benefits? (Including examples) HRForecast

Fringe Benefits Employee Benefits Expense

PPT FRINGE BENEFITS PowerPoint Presentation, free download ID3509830

Quick and Easy Small Business Fringe Benefits Packages

Fringe Benefit Tax bartleby

What Are Fringe Benefits? It Business mind

What are Fringe Benefits? Definition, Types, and Examples

PPT Chapter 15 PowerPoint Presentation, free download ID5644482

PPT Current Liabilities and Contingencies PowerPoint Presentation, free download ID5581085

PPT SPECIAL TREATMENT OF FRINGE BENEFITS PowerPoint Presentation, free download ID1632303

Fringe Benefits 10 PDF Employee Benefits Employment

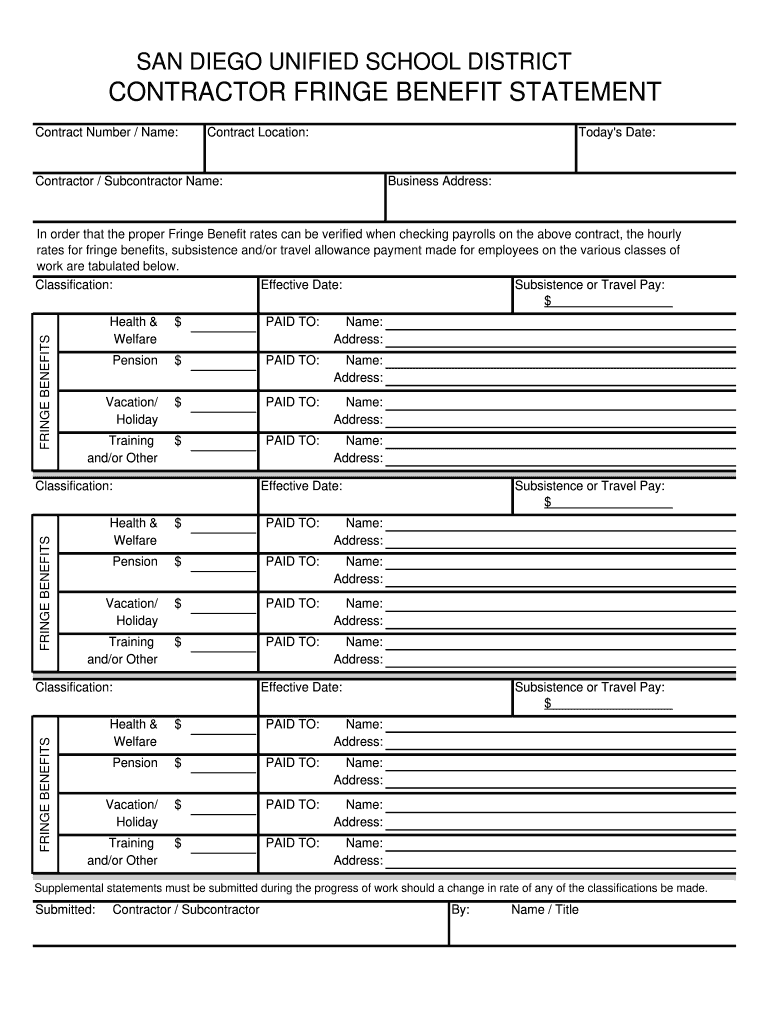

Fringe benefit statement Fill out & sign online DocHub

How to Calculate Fringe Benefits HR University

The Comprehensive Guide to Fringe Benefits AttendanceBot

Fringe Benefits Classifications employees; and managerial or supervisory positions Employee

:max_bytes(150000):strip_icc()/types-of-employee-benefits-and-perks-2060433-Final-edit-60cedb43c4014fdeb51aa3cd3c25f027.jpg)

Types of Employee Benefits and Perks

Fringe Benefits Examples YouTube

The employer may elect to add taxable fringe benefits to employee regular wages and withhold on the total or may withhold on the benefit at the supplemental wage flat rate of 22% (for tax years beginning after 2017 and before 2026). Treas. Regs. 31.3402(g)-1 and 31.3501(a)-1T.. Here are 16 examples of fringe benefits available: 1. Employee stock options. Stock options are contracts that enable an investor to buy, trade, or sell stocks in a business. Employee stock options often give employees the chance to own stock in the company for which they work at a discounted price.