Buy-to-let mortgage rates for first-time buyers. Typically, Buy-to-Let mortgage interest rates are higher than those of a standard mortgage. As a first-time buyer, there are many factors that influence what rates you pay. This includes: Lender's individual criteria; Deposit size; Your credit score; The property value; Potential rental income. Credit score. Size of deposit. Number of rental properties you already own. Many lenders will only lend up to a maximum of 75% loan-to-value (LTV) for buy-to-let mortgages. With a 25% deposit, you could borrow the remaining 75% of the property's value. However, loan amounts can be lower depending on your situation.

First Time Buyers, Find a mortgage, Purchases, Remortgages, Help to Buy, Buy to Let, Insurance

Firsttime buyers on the rise as buytolet mortgage market falls Real Estate Sales and

Mortgages KPM Property

Review our latest buytolet mortgage and remortgage options

First Time Buyer Axess Financial Services

The complete BuytoLet Guide all you need to know Money To The Masses

How To Get A BuyToLet Mortgage YouTube

The best and cheapest buytolet limited company mortgage rates

7 Tips For Getting Your First Buy To Let Mortgage YouTube

Buy to Let Mortgage Help Mortgage Buddy

Buytolet mortgage rates continue to fall Maxine Lester Lettings, St Ives

Buy to Let Mortgage Advice Top Mortgage Solutions

Buy To Let Mortgage UK Explained Q&A (Time stamped) YouTube

What is a Buy to Let Mortgage? Elems

Buy to Let Advisors Mortgage Advice Buxton Mortgage Co

Best Buy To Let Mortgage Best Deals UR Mortgage London

Buy To Let Mortgage For First Time Buyer Complete Guide TPSC

First Time Buyers, Find a mortgage, Purchases, Remortgages, Help to Buy, Buy to Let, Insurance

Buy to Let Mortgage Sussex Brighton Seagull Finance

Buy to Let Mortgages Q&A with Jacqui Knapp from The Mortgage Corner

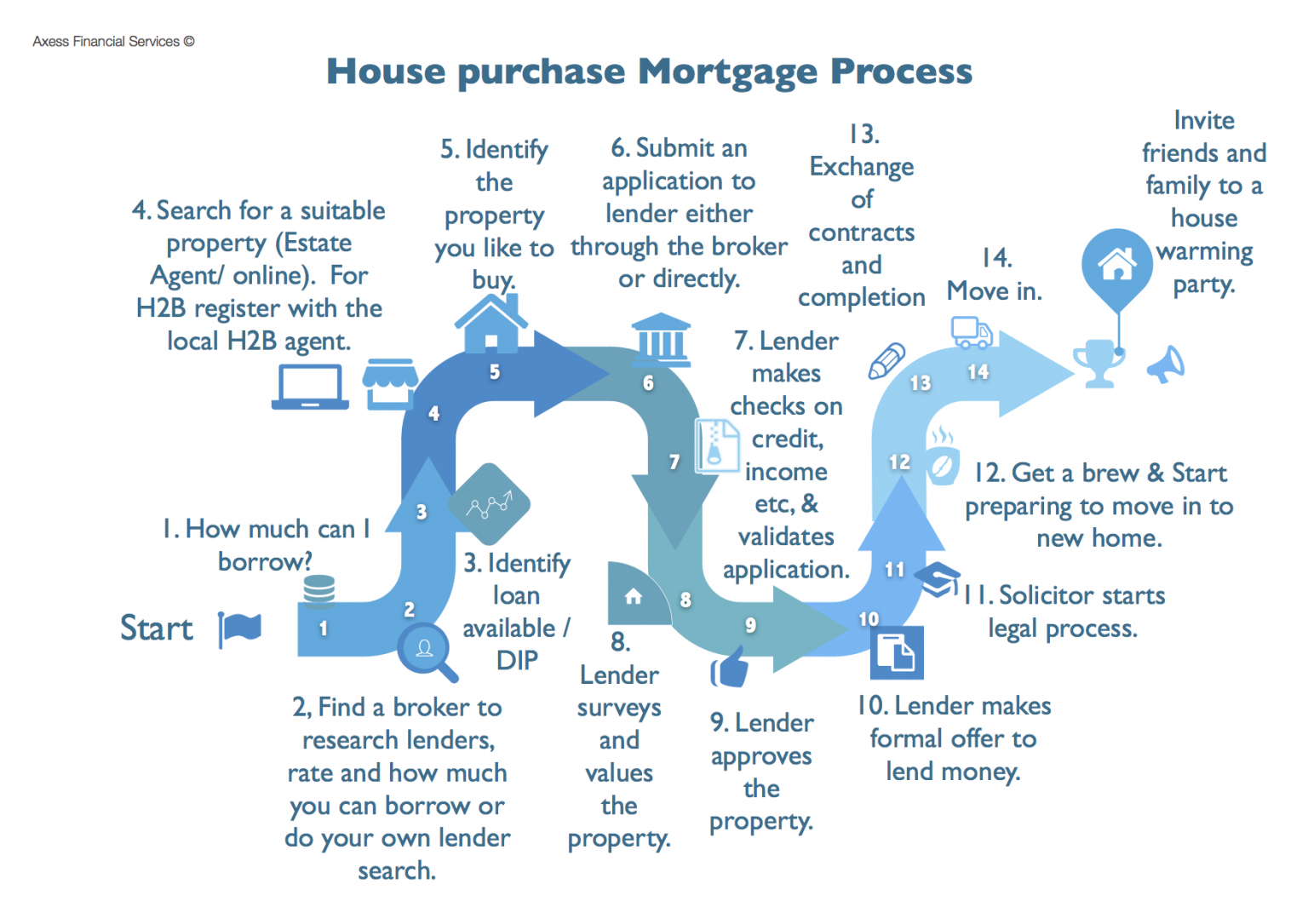

While the idea of a buy-to-let as a first-time property might be alluring, diving straight in usually means tougher hurdles for first-time buyers with no prior landlord experience. It certainly comes with more conditions than buying a residential home, whether you're a first-time buyer or not. For starters, managing a rental property requires learning various legal, tax and property.. Like residential mortgages, buy-to-let mortgages come at different rates and terms, so finding the best mortgage deal is still crucial. Read this guide to get acquainted with the rules, before you take the plunge, and use our buy to let mortgage calculator below. And consult our guide to mortgages for first-time buyers for even more info.